Payroll Management is considered a time consuming and arduous process. Bringing together multiple streams of inputs, adhering to local statutory requirements, validating the data prior to paying your employees accurately and in a timely manner for it to be managed in-house. Pay Master- payroll software enables you to mitigate these challenges effectively by delivering a seamless payroll processing capabilities. Keeping payroll software in-house ensures integrity and security of data and avoids hassles of dealing with third party vendors during each pay cycle.

SOFTWARE HIGHLIGHTS

- Complete employee information management system

- Flexible pay head creation and updating system

- Flexible salary creation filters

- Easy loan management

- Attractive pay slips, pay bills, pay schedules, statement of advances

- Reports like TDS, Bank statement, Pay bill summary

- Income tax management (form 16)

- Complete encrypted system for data integrity

- GPF broadsheets

- Provision for making DA arrears

- Automatic and manual data backup facility

- Pay suspension module

Complete payroll in just few minutes

Major Modules of Payroll Management System

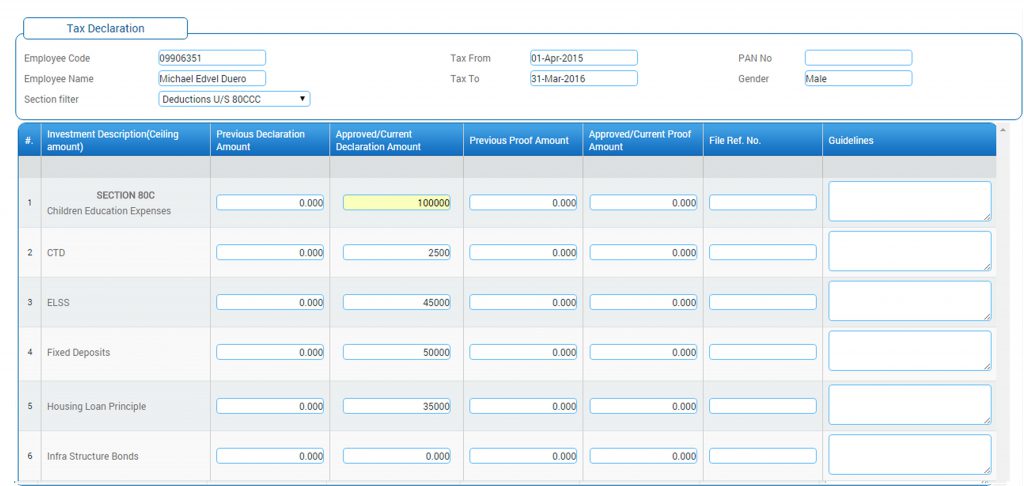

1.TAX Management

Country based tax slabs, tax declarations, investments, exemptions; other incomes are maintained and used for processing purposes.Form16 can be generated.

2.Employee Management

Employee Profile captures the details like

- Full Name

- Date of Birth

- Gender

- Designation

- Accommodation type

- Employee Type

- Basic Pay

- Grade

- PF Category (GFP/NPS)

- GPF Number

- Bank Details

- Income Tax Details

- Month of Increment

- City

- Group

- Department

- Bank Details

3. Pay Head Management

Pay head creation include the details like

Head Name

Pay Head Type

Transaction type (Earning/Deduction/Recovery)

Computed on

Effect on Net Salary

4. Loans Management

Loan/Advance Details

- Advance Type (Interest Bearing or Not)

- Advance Name

- Rate of Interest (if applicable)

- Duration

- Number of installments

Other things that you care about

Stay compliant with payroll laws

1. PROVIDENT FUND

Make accurate PF payments with PF electronic challan cum return (ECR) auto generated from Pay Master.

2. PROFESSION TAX

PT calculation is supported for all states in India and reports are auto generated for easy payment and filing.

3. EMPLOYEE STATE INSURANCE

Ready to file reports help in ESI payments and compliance even for multiple ESI codes.

4. INCOME TAX & TDS

Enable tax declarations by employees and make optimal tax deductions and payments. Comply with the filing requirements with ready to upload 24Q statements.

5. DIGITALLY SIGNED FORM 16

Generate digitally signed Form 16 and enable download for employees in their self-service portal for easy personal income tax filing.

6. OTHER COMPLIANCE REPORTS

Configure relevant reports for Factories Act and Shops Establishments Act with custom report creator.

Pay Master the solution to Payroll Management